For many founders in yesterday’s climate, getting capital from a tier 1 VC firm meant success. But founders, I’m going to let you in on a little known secret - taking Sequoia’s capital doesn’t guarantee your success. In fact, the less capital that you raise, the more options you have. And once you start generating revenue, you have the freedom to grow in a number of ways - via venture debt, revenue based financing, your own revenue… the list goes on.

In a recent blog post, we talked about how VCs have long asked founders for performance metrics without having to be beholden to performance metrics themselves. We believe that in venture capital, you must track your portfolio’s performance based on specific KPIs. This is particularly important at pre-seed and seed, where the fundamentals of the business are critical to setting the company up for long term success.

At Symphonic, this is core to the way we coach and support our portfolio companies. Companies with strong fundamentals have more power in the private market, and strong fundamentals set companies up for long term success in the event of an acquisition or IPO.

Reflecting on what we know works

As a founder myself, I know this first hand. Back in 2014, my co-founders and I joined the W’14 batch of Y Combinator with our startup, Move Loot. Move Loot was an online marketplace that helped people buy and sell used furniture. We were scrappy startup founders who found our first users on craigslist and offered to pick up and sell their stuff for them. We drove around San Francisco picking up furniture and listed it on our then very rough looking website. We grew very quickly out of our small storage space in San Francisco, and while that rapid growth earned us a spot in YC, we needed to develop a more structured approach to continue to grow.

When we joined the W’14 batch, our first conversation with the partners was about KPIs. We determined a few like GMV, burn, net revenue, and inventory supply that set us up for early success. We were a business that had revenue but we also had a lot of costs including delivery and pickup; and while we weren’t purchasing inventory outright, we wanted to list as much as we could because the better our product mix, the more we were able to sell.

Once we raised our seed round, we became early customers of Looker, setting up dashboards that monitored these KPIs and additional operational metrics that helped us look at inventory turn, time to list, and user acquisition. The practice of tracking these metrics was paramount in allowing us to make adjustments as the company grew. More importantly, it laid the groundwork for us to create a data-driven culture.

As an angel investor and part time COO, and now as a partner at Symphonic - I’ve taken those early lessons around KPI monitoring with me. It’s a good early practice and ultimately gives founders more agency and power in conversations about future investment. The stronger your fundamentals, the easier it is to raise future capital and there are more types of capital available to you.

Metrics that Matter

We believe at seed and pre-seed that there are few metrics that matter. We developed this formula based on my experience as an operator, Sydney’s experience in early stage investing and our shared experience with our early stage investments. When we begin our work with founders, we start with our North Star. Where do we want to go? What’s our big dream? From there, I take a page out of my teaching days, and start to backwards plan using some key KPIs.

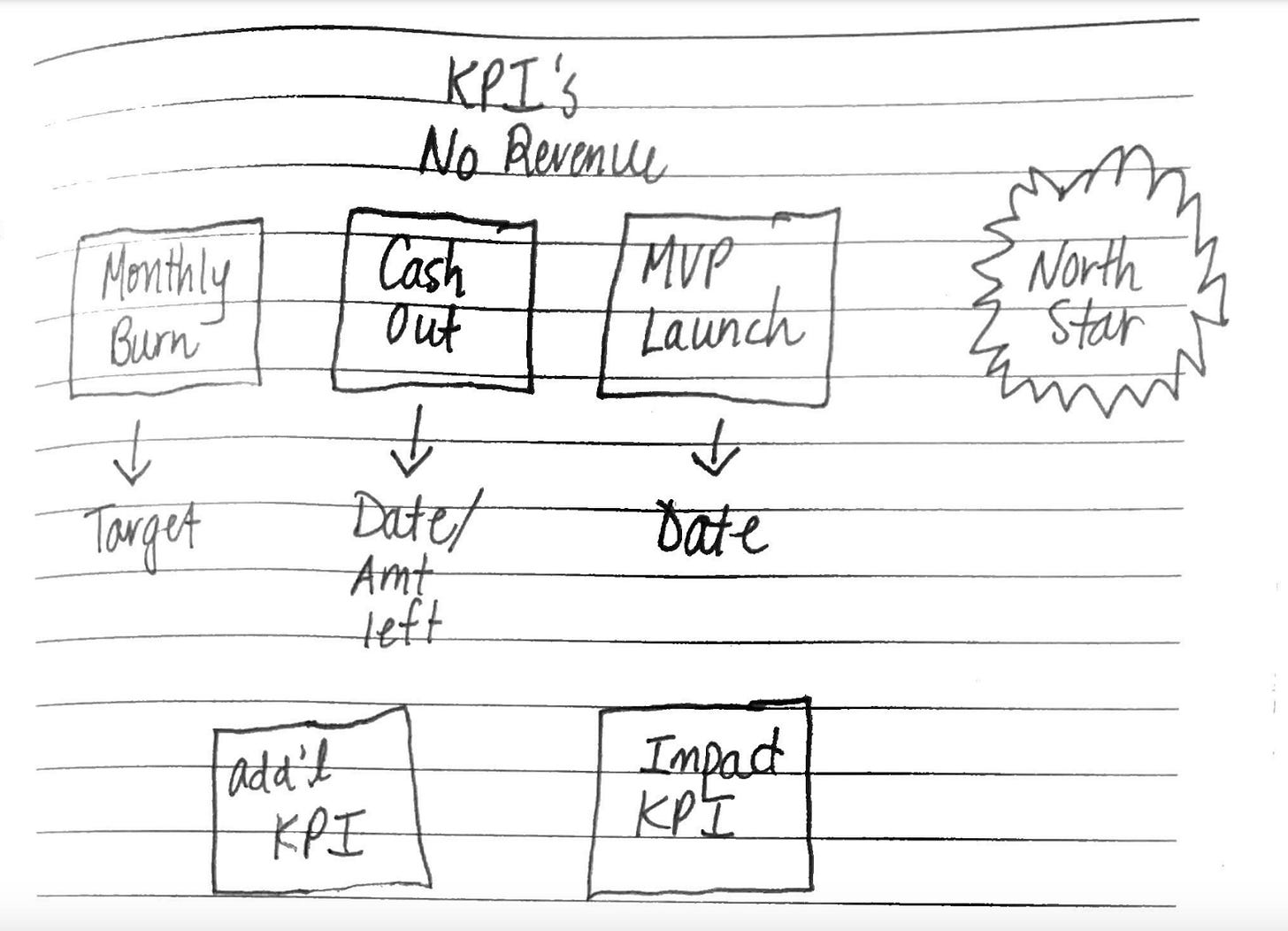

For our companies that are pre-revenue, we like to track monthly burn, cash out, and the launch date for the MVP. We also come up with one additional KPI to track based on the business and one impact metric since that is part of our core focus.

Once the company has revenue, we transition to tracking top line revenue (GMV), net revenue, and monthly burn as well as cash out date. This helps us understand margin and wrap our heads around where we may be able to make adjustments to strategy as the business shifts.

We then work with our companies on one jointly determined KPI, specific to their business, and one impact metric. These are the KPIs that will help set our portfolio companies up for long term success and give our founders the power to determine how they want to grow their businesses.

Shifting Mindset for Long Term Success

Part of this belief is rooted in our observation about a shift in how venture capital may need to adjust in order for companies to be able to have success in the public market. In the early days of VC, founders would raise enough money (usually through Series A or Series B) to get them to a place where they could go for an IPO but in the last decade, companies have stayed private longer by continuing to raise private capital - resulting in huge valuations and outsize expectations for when a company decides to go public.

Case in point: WeWork. WeWork was once valued on the private market at $47 billion dollars in 2019 after Softbank put in over $2 billion dollars. When the company first filed to go public via a SPAC in 2019, they posted close to $1.54 billion in revenue for the first 6 months of 2019, and roughly $900 million in losses. This meant that the company was valued at more than 30 times its revenue. By the time of their IPO in 2021, the opening share price was $11.31 cents a share, valuing the company at $9 billion - a $38 billion dollar decrease in value from its $47 billion dollar valuation. While the pandemic certainly had an impact, today the company is worth a mere fraction of its initial $9 billion dollar public market valuation. Recently, the company announced a reverse stock split to avoid getting kicked off the public market, and today the company is valued at roughly $280 million dollars.

All of this begs the question - if WeWork filed for an IPO sooner to instead of continuing to raise in the private market, would it have been valued more reasonably and forced to be more thoughtful about both its growth trajectory and overall spend?

I’d like to think if we’d worked with WeWork that we would have encouraged a more conservative approach to managing the capital that they had and continued to raise - it would have allowed them to weather the pandemic a little bit better, and we’d have helped them think about where to double down and maximize spend for growth in markets where they could have grown most quickly. We may also have recommended against continuing to raise private capital and encouraged an earlier IPO. WeWork is a real estate business and probably should have been run more like one. Unfortunately, it seems many of the tech IPOs from 2020 to 2022 experienced and are experiencing a similar fate when hitting the public market.

As early stage investors, we are on the company building journey with our founders for the long haul - for what could amount to a decade or more as the journey from infancy to IPO or acquisition can be lengthy. At Symphonic, we know that sound business fundamentals and a structured approach to goal setting will help set our founders up for long term success and ultimately allow them to own their own destiny. This is where the market is headed, and the future success of the tech industry is going to rely on a more thoughtful and structured approach to company building.

This post was written by Shruti Shah, a venture partner at Symphonic Capital. She is seasoned operator and angel investor and has spent the last 5 years working as a Fractional COO and Entrepreneur in Residence at SVB and at Nike. Shruti is also a YC alum and formerly the co-founder and COO of YC-backed Move Loot - a used furniture marketplace.

Thank you to Sydney Paige Thomas for your feedback and help editing this post.