The Hype Cycle Giveth, And Taketh Away: Ushering in a New Business Model for Pre-Seed Funds to Survive & Thrive In The New Normal

The early-stage venture ecosystem is going through immense change. Read on to learn how these changes allow VCs to build their funds based on business models that align with real value creation.

I was recently in conversation with Mark Suster, a veteran VC, about the cyclical nature of our industry. Mark mentioned that this current moment felt like 2010 all over again.

2010 had been an exceptionally tough year in VC, for reasons that became more clear in 2012, that Mark outlined in his “It’s Morning in VC” post: 1) massive over-funding, which led to 2) a massive correction in the value of the public stock markets, which in turn, led to 3) limited exit opportunities for half a decade.

Sound familiar?

But that dark period created an opportunity for our industry to reset. And much like what Mark saw in 2012, the turbulence of the last few years brings us the present opportunity.

The VC community has a choice to face this moment head-on and return to the fundamentals of our profession: build companies that deliver exceptional value and stand the test of time. This requires us to build investment vehicles that return capital to LPs through focus, discipline, and metrics that truly matter.

As someone who’s been focusing on Pre-Seed for the past 7 years, I see an exceptionally exciting time ahead – now is the time for early-stage investors to become more accountable to and more aligned with LPs and founders.

In this post, I’ll go over how we got to where we are today, why the old system is broken, and a new business model for early-stage VC that has emerged.

Pre-Seed has always been hard, but now it’s just wild

What makes a good VC? Ostensibly, it’s the ability to pick winners. But how you go about it is murky, and often criticized for being not much better than luck. Success in Pre-Seed is even more obfuscated for several reasons:

Lack of dedicated focus from career VCs. Many investors treat Pre-Seed as merely an entry point for their own VC careers. Few have put in the time to build a true, deep expertise, and once they go on to raise larger funds, the grind of focusing on Pre-Seed is immediately abandoned.

Acceleration of capital deployment cycles. Traditionally, VC funds were expected to be deployed within 5 years. But over the past decade, the timeframe has shifted to 1-2 years. Supposedly, this was because there were just “too many good deals,” and if you were holding onto capital, it was because you were getting out-hustled by competitors.

Ability to raise the next round as a proxy for success. With the speed of dealmaking, and more and more funds getting pushed to deploy within 1-2 years, companies were pushed to see meaningful mark-ups within 6-8 months – regardless of the company’s actual progress in that time.

There’s a key factor in this picture, and that’s the challenge of using later-stage investing performance metrics to evaluate early-stage activity – when there are no metrics.

6-8 months of growth for a Pre-Seed startup is very different from that of a later-stage company. Pre-Seed almost always means pre-launch, meaning it’s a stage where companies are still experimenting to find Product-Market Fit, and there is little meaningful performance data or revenue. Yet, later-stage investors would still invest in them because they were also expected to deploy capital so quickly. This created a system that was optimized for the performance of funds, not companies.

This tenuous system relied on later-stage capital to exist.

When money was flush, success in Pre-Seed meant having a lot of later-stage investor friends willing to mark up your deals. But with late-stage capital drying up, Pre-Seed funds are no longer able to rely on their well-capitalized peers to support their deals financially. This means that for Pre-Seed to survive as a category, the business model must change.

My recent conversations with LPs have echoed this shift. In recent years, they’ve become overwhelmed by funds returning for re-ups (return requests for additional capital) with increasingly large fund sizes. Many LPs have, to put it simply, run out of capital to invest in VC firms. By necessity, the great experiment in 1-2 year deployments is over, and the traditional 5-year timeframe is making a comeback.

The Solution

For Pre-Seed fund managers, there is an opportunity to take a distinct POV and strategy that’s fitting for the unique context of early stage: company traction + founders’ ability to succeed. In the next months and years, the great Pre-Seed investors will distinguish themselves by proving out a specific POV on identifying great founders and executing on relevant metrics, instead of relying on endless outside markups and validation. This enables investors to create with founders company valuations based directly on their expected outcomes.

Distributions to Paid in Capital (DPI) is the new Internal Rate of Return (IRR).

About time.

So now that late-stage capital has come to a screeching halt, how do Pre-Seed funds capitalize on their best companies?

Through partnerships with other aligned funds and follow on investments with their own reserves.

Pre-Seed funds will need to develop strong networks with aligned, smaller funds, and set aside follow-on capital to support their companies themselves. This strategy requires Pre-Seed funds to maintain heavier reserves than ever before, and a fundamental rethinking of how much capital companies truly need before they IPO.

Amazon only needed $8M to IPO. Do the current wave of companies truly need hundreds of millions of dollars to succeed? I don’t think so, and the current market correction seems to support this.

Closing a long-existing gap in the early-stage market

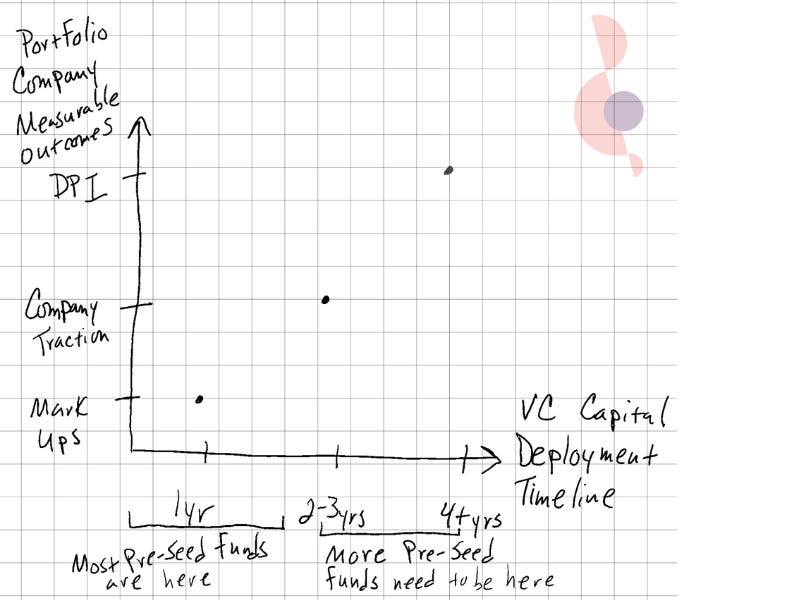

Here’s a map of the current Pre-Seed ecosystem, showing a gap of Pre-Seed funds focused on that 3-5 Year Deployment Cycle.

From the unique position of having focused on Pre-Seed for the past 7 years, I have developed a clear vision for what is needed in the VC landscape for the future that has already arrived – and I decided to launch Symphonic Capital, a Pre-Seed firm that closes this gap. The flow of cash over the last few years has enabled hundreds of new Pre-Seed funds to launch, but this market will separate the signal from the noise faster than any of us had expected. And in order for these new funds to succeed, we need to collaborate more effectively with other smaller, aligned funds, and be less dependent on the mis-aligned later-stage funds. VC has always been a patient capital game, and that’s why the future of VC looks a lot like the past:

We need Pre-Seed funds built with business models that align with real-world outcomes.

In order to build a Pre-Seed fund whose stakeholders are founders, you must build a fund that is full-stack + with heavy reserves to back the best companies in a way that truly aligns with your business model.

In Closing

VCs have long asked founders for performance metrics without having to be beholden to performance metrics themselves. This is all about to change.

The next generation of VCs are building out the right business models for their funds from Day 1 - that means:

Having a strong point of view around what underlying company metrics are necessary to track in order for their fund to return capital to their LPs,

Being capitalized enough to support the companies in their portfolio themselves and through collaboration with other similarly sized funds, and

Becoming less dependent on later-stage VCs whose business models aren’t aligned with their own.

My peers and I will have to do the hard work of coming up with each of our own definitions of success. This will be a set of constantly evolving metrics, but the focus here is the new normal. As investors, we constantly tell our companies to adapt – and it's time we live it ourselves.

In future posts, I’ll be sharing more about Symphonic’s approach to diligence and portfolio construction, as well as my strategy for bringing on my partners, Jennifer Kim and Shruti Shah to enable Symphonic to provide the best-in-class portfolio support. Subscribe / reach out to stay in the loop!

Thanks to Jennifer Kim for co-writing this post with me, as well as those who provided further edits and thoughtful feedback.

If you’re interested in going deeper on any of the topics I listed above, here are some awesome resources:

Samir Kaji of Allocate describes the return to 5-year fund deployment cycles:

https://twitter.com/Samirkaji/status/1682553652429611008?s=20

Bryce Roberts of Indie VC describes the pressure early stage funds are under to adopt business models of later stage funds https://bryce.medium.com/risky-business-venture-scale-vs-venture-risk-9593cf5ce66c

Discussion on LP pressures they are currently experiencing: https://twitter.com/fintechjunkie/status/1682737290018189313?s=20

https://www.vice.com/en/article/4a3az9/venture-capital-vcs-existential-too-many

More info on fund analysis: https://docs.preqin.com/misc/Performance_Ratios_and_Example.pdf

https://www.fundable.com/learn/startup-stories/amazon

https://www.cnbc.com/2023/06/29/tech-ipo-drought-reaches-18-months-despite-nasdaq-first-half-rally.html

Insightful, informative, and well-written. Thank you, Sydney!

Excellent post Sydney. Spot on!